santa clara property tax rate 2021

The median property tax also known as real estate tax in Santa Clara County is 469400 per year based on a median home value of 70100000 and a median effective property tax rate of 067 of property value. Owners must also be given an appropriate notice of rate escalations.

The median annual property tax payment in Santa Clara County is 6650.

. Santa Clara County has one of the highest median property taxes in the United States and is ranked 38th of the 3143 counties in order of median. As of June 18 2021 the internet website of the California Department of. Tax Rates are expressed in terms of per 100 dollars of valuation.

The Santa Clara sales tax rate is. The tabulation below and continued on the next page represents a summary of the various tax rates levied in the County of Santa Clara for the Fiscal Year 2020-2021. What is the sales tax rate in Santa Clara County.

County of Santa Cruz. Table of Contents. Close SCCGOV Menu.

Santa Clara County collects on average 067 of a propertys assessed fair market value as property tax. FY201718 PDF 137 KB. Whether you are already a resident or just considering moving to Santa Clarita to live or invest in real estate estimate local property tax rates and learn how real estate tax works.

There is no applicable city tax. Information in all areas for Property Taxes. Learn all about Santa Clara County real estate tax.

Santa Clara County has one of the highest median property taxes in the United States and is ranked 38th of the. Property Tax Distribution Charts Archive. Santa Cruz County Property Tax Rates.

0375 lower than the maximum sales tax in CA. A tax rate area TRA is a geographic area within the jurisdiction of a unique combination of cities schools and revenue districts that utilize the regular city or county assessment roll per. Because of these high home values annual property tax bills for homeowners in Santa Clara County are quite high despite rates actually being near the state average.

The minimum combined 2022 sales tax rate for Santa Clara California is. The Santa Clara County sales tax rate is. County Retirement Levy 003880.

You can print a 9125 sales tax table here. Compiled by Edith Driscoll. The County sales tax rate is.

The California state sales tax rate is currently. Look Up Any Address in Your Cty for a Records Report. 21 a of the Texas Constitution.

Property Tax Distribution percentages for the County of Santa Clara. Then a formal meeting regarding any proposed tax increase is. Ad View Your Homes Appraisal Value Suggested Listing Price - Fast and Free.

See Results in Minutes. 1 Maximum Tax Levy 100000 Santa Clara County. It limits the property tax rate to 1 of assessed value ad valorem property tax plus the rate necessary to fund local voterapproved debt.

This is the total of state county and city sales tax rates. Santa Clara County collects very high property taxes and is among the top 25 of. Search for individual property tax rates using.

Santa Clara establishes tax levies all within California statutory directives. On Monday April 11 2022. 2021-22 Tax Rates.

Santa Barbara campus rate is 775 8750. All real estate not falling under exemptions should be taxed evenly and uniformly on a single current market value basis. SANTA CLARA COUNTY CALIF The County of Santa Clara Department of Tax and Collections DTAC representatives remind property owners that the second installment of the 2021-2022 property taxes is due February 1 and becomes delinquent at 5 pm.

01-024 SANTA CRUZ CITY Famis Index Fund Name School. Property Tax Rates. Proposition 13 the property tax limitation initiative was approved by California voters in 1978.

Whether you are already a resident or just considering moving to Santa Clara County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. The 2018 United States Supreme Court decision in South Dakota v. This date is not expected to change due to COVID-19 however assistance is available to.

The median property tax in Santa Clara County California is 4694 per year for a home worth the median value of 701000. Learn all about Santa Clarita real estate tax. As of June 18 2021 the internet website of the California Department.

For tax rates in other cities see California sales taxes by city and county. Skip to main content How do I. Tax Rate Areas Santa Clara County 2022.

The median home value in Santa Clara County is among the highest in the nation at 913000. Ad Request Full and Updated Property Records. Actually tax rates mustnt be increased before the general public is previously apprised of that intent.

Then a formal meeting regarding any proposed tax increase is. Property taxes are levied on land improvements and business personal property. Property Tax Rate Book Property Tax Rate Book.

The 9125 sales tax rate in Santa Clara consists of 6 California state sales tax 025 Santa Clara County sales tax and 2875 Special tax. This is the total of state and county sales tax rates. COUNTY OF SANTA CRUZ.

The minimum combined 2022 sales tax rate for Santa Clara County California is. In establishing its tax rate Santa Clara must respect Article VIII Sec. The California sales tax rate is currently.

Look Up an Address in Your County Today. All Taxing Agencies. Santa Clara County California.

Learn about the your County of Santa Clara property tax bills.

Property Taxes Department Of Tax And Collections County Of Santa Clara

Santa Clara County Ca Property Tax Calculator Smartasset

What You Should Know About Santa Clara County Transfer Tax

Property Taxes Department Of Tax And Collections County Of Santa Clara

Santa Clara County Property Tax Tax Assessor And Collector

Santa Clara County Property Value Increases In 2021 San Jose Spotlight

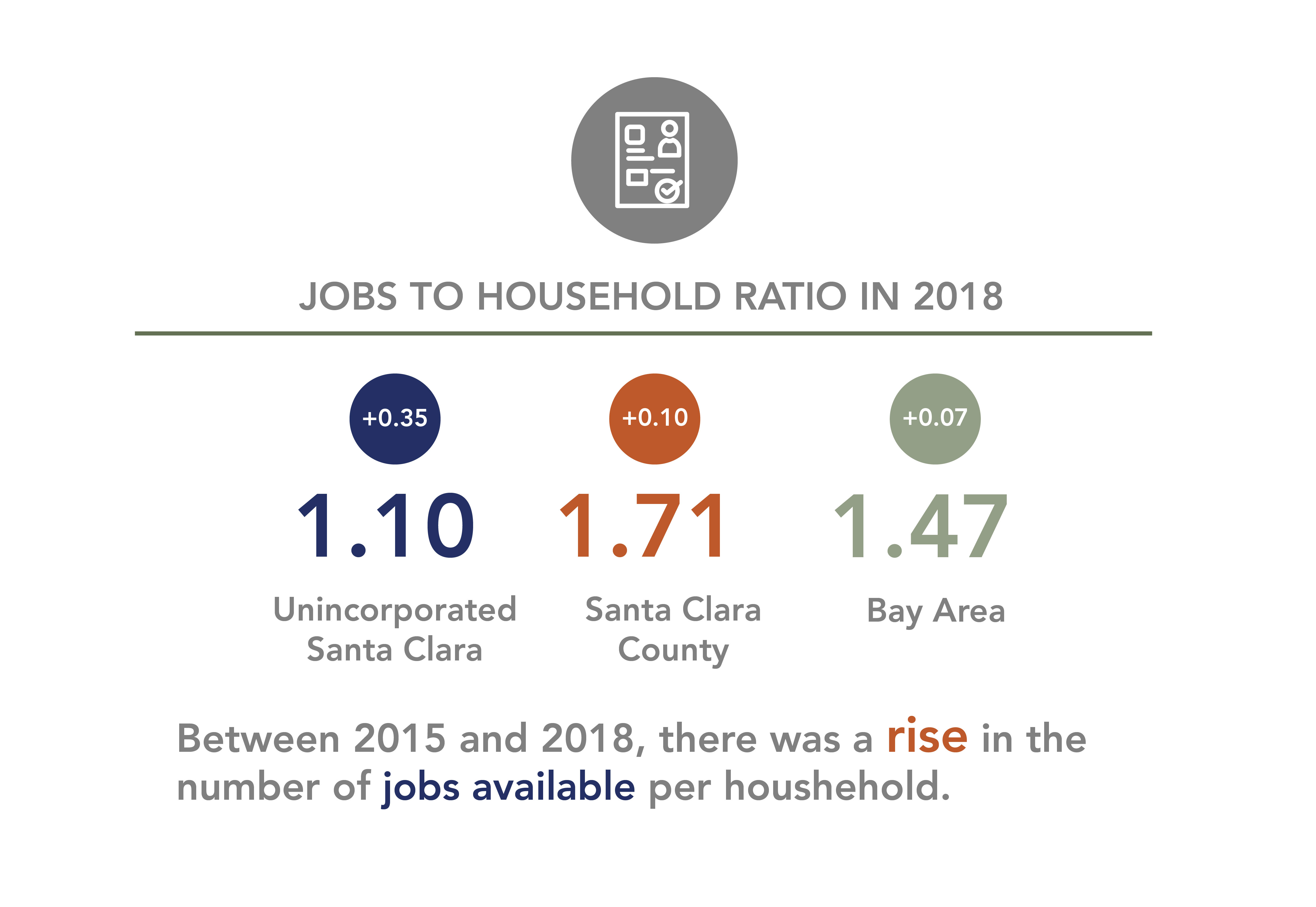

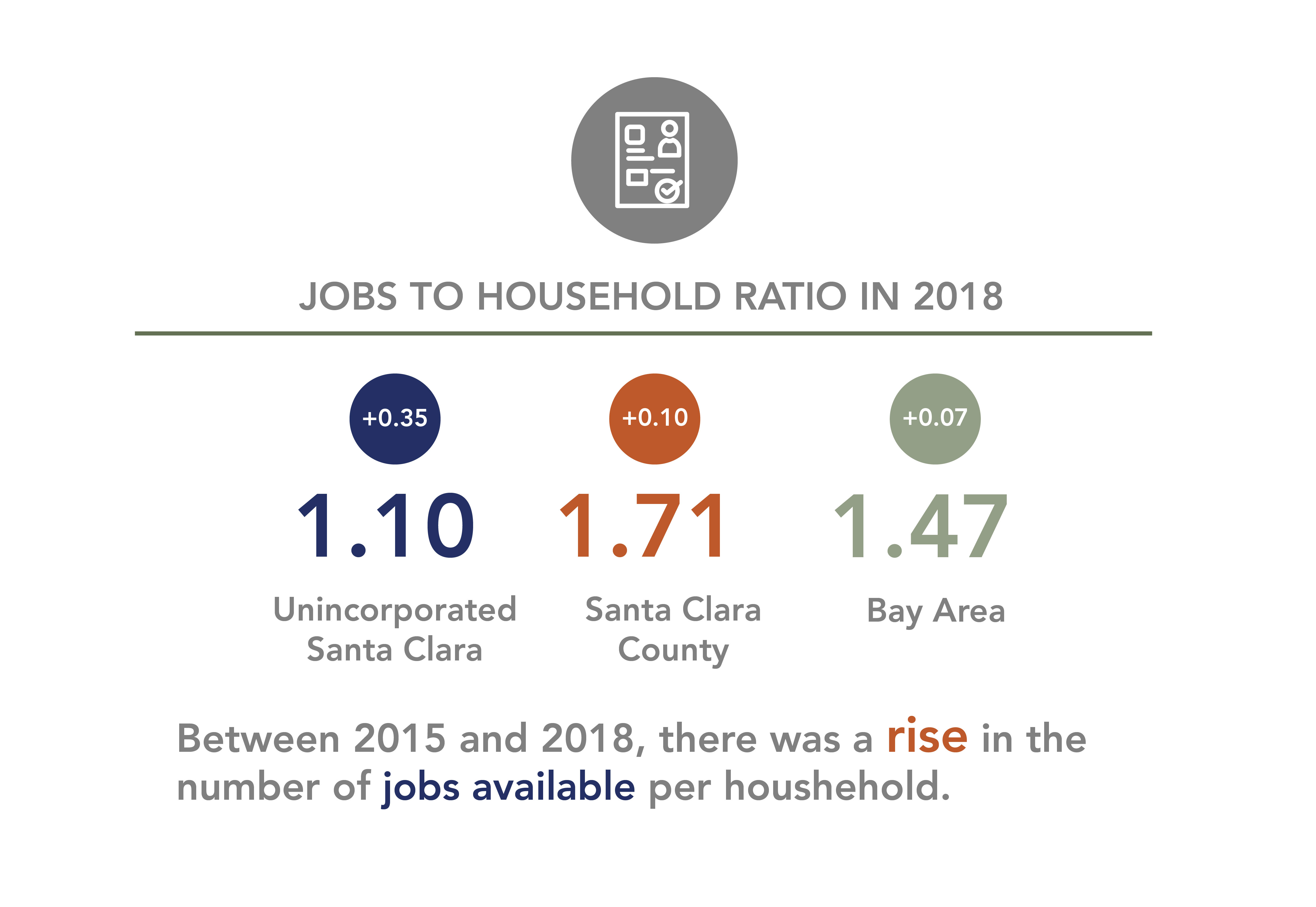

Housing Element Update 2023 2031 Department Of Planning And Development County Of Santa Clara

Santa Clara County Ca Property Tax Calculator Smartasset

Santa Clara County Property Value Increases In 2021 San Jose Spotlight

Property Tax Rate Book Controller Treasurer Department County Of Santa Clara

Santa Clara County Ca Property Tax Calculator Smartasset

Santa Clara County Ca Property Tax Calculator Smartasset

Santa Clara County Property Value Increases In 2021 San Jose Spotlight

Property Taxes Department Of Tax And Collections County Of Santa Clara